- Author Isaiah Gimson gimson@periodicalfinance.com.

- Public 2023-12-17 02:53.

- Last modified 2025-01-24 12:06.

Preparation of a quarterly, based on accounting data, package of documents for the Pension Fund of the Russian Federation often causes certain difficulties. Special software is designed to facilitate this responsible process.

It is necessary

- - PC with installed Windows operating system and Internet access;

- - Spu_orb program;

- - Printer.

Instructions

Step 1

Use the link - https://www.pfrf.ru and go to the official website of the Pension Fund of the Russian Federation. In the left part of the window that opens, click on the section "Employers" and activate the item "Free software for employers". Click on the button "Download" Spu_orb " and after downloading the installation file, install the program on your computer.

Step 2

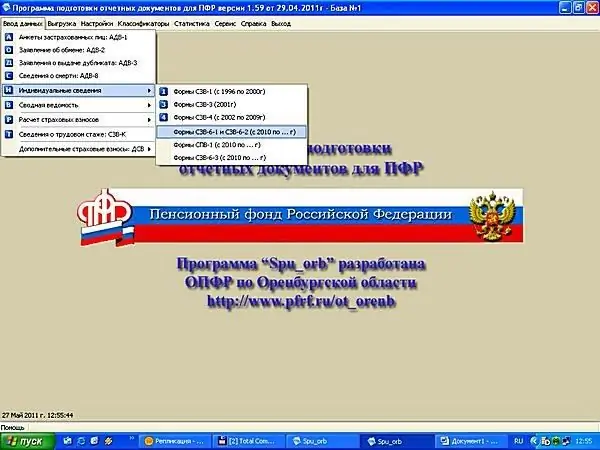

Run the Spu_orb program, open the reporting form for the Pension Fund of the Russian Federation and fill in the "Information about the enterprise" section. On the first page of the report, enter all the details of the organization, indicating its name and legal address, TIN and registration number of TFOMS, which is provided by the Medical Fund.

Step 3

Enter the data in the second section of the reporting. Using the information from the payroll accounting for employees, provide information on assessed contributions. When filling out the third and fourth sections of the reporting form to the Pension Fund of the Russian Federation, enter the data on contributions using preferential accrual rates.

Step 4

Fill out the first section of the reporting form to the Pension Fund of the Russian Federation, based on the data of the second, third and fourth. If the company applies the simplified taxation system (simplified taxation system), leave the third and fourth sections unchanged, and in the second, indicate information on assessed and paid contributions. Enter the data in the fifth section of the report only if the organization has an overpayment or debt to the Pension Fund of the Russian Federation at the beginning of the last reporting year.

Step 5

Submit reports to the Pension Fund of the Russian Federation on a quarterly basis, starting in 2011. Print two copies of the generated report and save one on electronic media. Submit the package of documents to the branch of the Pension Fund of the Russian Federation at the place of registration of the organization.