- Author Isaiah Gimson gimson@periodicalfinance.com.

- Public 2023-12-17 02:53.

- Last modified 2025-01-24 12:06.

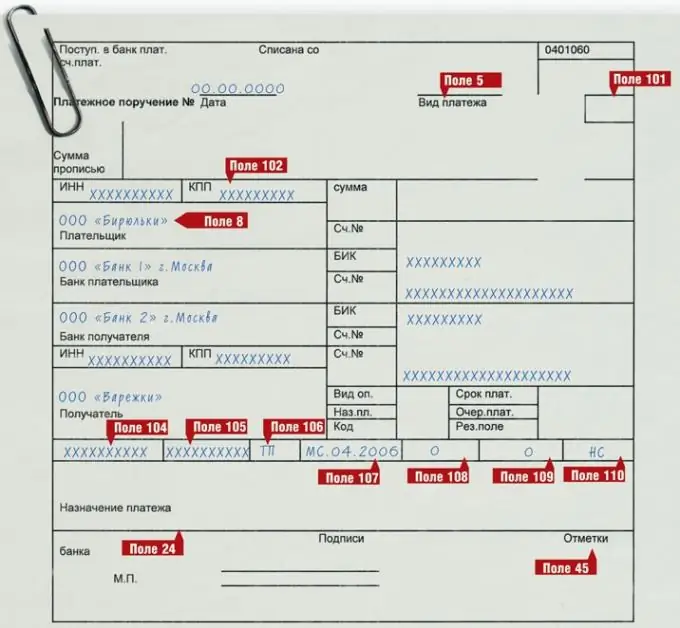

A payment order is a settlement document, on the basis of which the bank, in which the client's funds are stored, pays orders for transferring funds to the recipient's accounts within the time period specified in the account service agreement. The payment order must reflect all the necessary details, otherwise the payment will not be processed.

It is necessary

- - a computer,

- - access to the Internet

Instructions

Step 1

To draw up a payment order, you can use any accounting program, including those freely distributed on the Internet, as well as online on websites that provide accounting services. Install the program on your computer. Open the main window. Select "Payment order" from the drop-down list. In the window that opens, you need to fill in the proposed fields.

Step 2

In the "Payer data" field, enter the name of the taxpayer, his account number, taxpayer identification number (TIN).

Step 3

In the next tab "Payer's bank" fill in the data on the name, location of the payer's bank, its bank identification number (BIC), and the number of the correspondent account. This data must be in your bank agreement.

Step 4

Indicate the name of the document, its OKUD OK 011-93 code and its numbers, as well as the date (day, month, year) of the statement.

Step 5

In the field "Payee details" enter the number of the local tax office and its full name.

Step 6

In the "Beneficiary's bank" tab, fill in the data on the name, location of the beneficiary's bank, its bank identification number (BIC), and the number of the correspondent account.

Step 7

In the appropriate field, enter the payment amount and the type of transaction in accordance with the accounting rules.

Step 8

When paying taxes, specify the budget classification code. The correct code must be selected from the "KBK Handbook".

Step 9

In the appropriate fields (101 - 110), fill in the data on the tax period, order of payment.

Step 10

In the additional field, you can enter some specifying points regarding the payment and its name.