- Author Isaiah Gimson gimson@periodicalfinance.com.

- Public 2023-12-17 02:53.

- Last modified 2025-01-24 12:06.

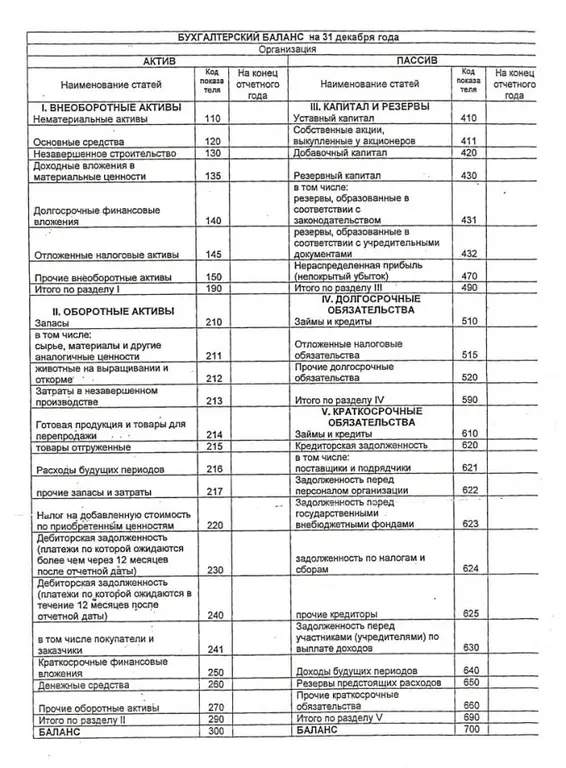

Balance sheet (or form No. 1, as it is called in the accounting report) is one of the most important accounting documents of an enterprise, which reflects its financial condition in monetary form for a certain period of time. The asset of the balance sheet reflects data on current and non-current assets, in liabilities - the capital of the enterprise, as well as its long-term and short-term liabilities.

It is necessary

Accounting software or reporting forms, general ledger of account balances

Instructions

Step 1

Fill out the header on Form 1, or enter the data into a computerized accounting program.

Step 2

Complete the first section of the asset - non-current assets. It takes into account: fixed assets of the enterprise, which can be invested in construction, whether it is completed or not, in material values, various assets. These data are entered in the corresponding lines of the prepared balance sheet form.

Step 3

Complete the second section of the asset - current assets. It takes into account: various stocks of the company, VAT amounts not yet accepted for deduction, accounts receivable, investments of the company invested for a short period, free finances and other assets.

Step 4

Complete the third section of the liability - equity and reserves. Here, such types of capital as authorized and additional capital are taken into account. Provides information about the reserve capital, for example, deferred for future planned costs. This paragraph should also indicate retained earnings.

Step 5

Complete the fourth section of the liability - long-term commitments. It takes into account: long-term loans, for example, loans. At this stage, the liabilities to the tax authorities that were deferred for a number of reasons, as well as other liabilities for payments on behalf of the enterprise, are indicated.

Step 6

Complete the fifth section of the liability - current liabilities. It takes into account: loans and credits taken for a short term, debt on such, debt to the founders. Planned incomes are entered into the balance sheet, as well as expenses and finances that are reserved for them. Short-term liabilities should also be indicated.