- Author Isaiah Gimson gimson@periodicalfinance.com.

- Public 2023-12-17 02:53.

- Last modified 2025-01-24 12:06.

In case of loss or theft of the Sberbank of Russia card, first of all, it is imperative to block the card. This will prevent attackers from using your funds. Sberbank customers do not always take the loss of a card seriously, since it is protected by a pin code. However, in the event of theft, the attacker could spy on the pin code in advance. Also, sometimes cardholders write a PIN code on the back of the card (so as not to forget it) or keep it next to the card (for example, on a small piece of paper in their wallet). In some cases, you can even use your funds without a pin code. An online payment can be made knowing only the card number, the name and surname of its owner, as well as the three-digit code that is imprinted on the back of the card. And some stores do not even require you to enter a PIN code to withdraw funds. In addition, now widespread ATMs - "phantoms", which do not return the card. The PIN code is read when it is entered, and in the future, the card can be used by the person who removed the card from the ATM. There are several ways to block Sberbank cards.

It is necessary

passport, code word, telephone, computer with Internet access

Instructions

Step 1

The first way is to make a phone call. Sberbank has a round-the-clock hotline (8 800 555 55 50 - a toll-free number for calls within Russia, 8 495 500 55 50 - a number for calls from anywhere in the world, while the cost of the call corresponds to your tariff plan). Before calling the indicated numbers, you need to remember or look at the keyword that you specified when concluding a card service agreement. The operator will ask you to name this word to make sure that the card is blocked by its owner, and not by an intruder. After greeting the answering machine, you need to press the "0" button on the phone in tone dialing mode. During the conversation, the operator will ask you to clarify which card you want to block (if there are several of them) and the reason for blocking the card. The card will be immediately blocked, but then you will need to come to the office and write a statement about the loss / theft of the card. The operator will tell you how much time you have to visit the Sberbank branch. If you do not have time to come to the department within the specified time, then card transactions will not be suspended.

Step 2

The second way is to use the Mobile Banking service. In this case, you can block the card using SMS. You can activate the Mobile Bank service at any Sberbank office with operators or through self-service machines. If the service is activated, send to number 900 an SMS with the text "Blocking N … N b" or "BLOKIROVKA N … N b", or "BLOCK N … N b", or "03 N … N b". In this case, N… N is the last 5 digits in the card number, and b is the blocking code.

If you have lost the card, then in place b put 0. If you think that someone stole your card, in place b put 1. If the ATM did not return your card or it was left by you at the ATM, then in place b put 2 Other reasons - 3.

In response, you will receive an SMS with a confirmation code that you really want to block your bank card. Within 5 minutes you need to send this SMS to number 900. 5 minutes is the validity time of the code. When choosing this method of blocking, you do not need to come to the Sberbank branch and write an application.

Step 3

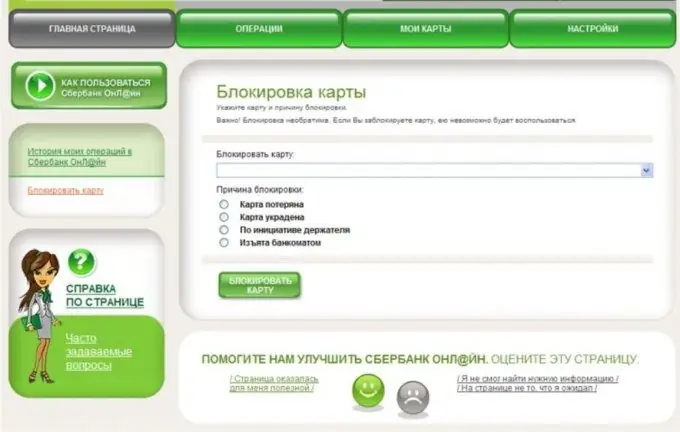

The third way is to use the Sberbank-Online service. Sberbank-Online is an Internet service for Sberbank users with a user's personal account. The personal account displays the movement of funds on the user's card, it is possible to open a deposit, the ability to transfer funds to a card of Sberbank or any other bank, the ability to make electronic payments. To enter Sberbank-Online, enter your username and password. If you have activated the "Mobile Bank" service, then you will receive an SMS with a code on your mobile phone, which you need to confirm the entry into the service. You can also confirm the entrance using the password specified on a special receipt from the ATM (you must make a corresponding request at the ATM in the "Sberbank-Online" tab), as well as the password from the Sberbank mobile application.

To block a card, open the Cards tab in the Sberbank-Online service. Then select the card that you need to block. If there are funds on it, transfer them to your other card or to the card of a close relative. Click on the "Card operations" tab, where you will be offered several options for card operations. Then click on the "Block" option. The service will offer you a choice of several reasons why you are blocking the card (loss, theft, or your personal desire). Next, you will need to confirm the blocking using a password or SMS message. You do not need to come to a Sberbank branch to submit an application (as is the case with the Mobile Bank service).

Step 4

The fourth way is to immediately come to the nearest branch of Sberbank. You must have an identity document (passport) with you. The department will give you a sample statement on the loss / theft of the card, which you will need to fill out (indicate the last name, first name, patronymic, card number, passport details, reason for blocking), you will also need to name the code word. The operator will accept the application and block your card. You can block a card temporarily (with the possibility of restoration) or on a permanent basis (in this case, the card cannot be unblocked, only a re-issue is possible). In case of reissue, the cardholder will have to pay a certain amount for the service provided, set by the bank. Information about the readiness of a new card will come to you via SMS. You do not need to come to the Sberbank office before the arrival of an SMS message about the readiness of the card. The card renewal process can take several weeks, while the card reissue will take from 3 to 10 days. This way you can save time and protect your funds from intruders.