- Author Isaiah Gimson gimson@periodicalfinance.com.

- Public 2024-01-11 15:34.

- Last modified 2025-01-24 12:06.

With the development of electronic banking services, helping loved ones has never been easier, even when they are far away. If you have a Sberbank debit card, you can transfer funds from it to another owner of any bank card in a matter of minutes. You only need to choose the most convenient way for you to carry out this operation.

It is necessary

- - Sberbank debit card;

- - a mobile phone with a connected "Mobile Bank" service;

- - the card number of the transfer recipient or his mobile phone number;

- - a means of access to the Internet or a self-service device of Sberbank.

Instructions

Step 1

If you have a computer, tablet or smartphone, the easiest way is to transfer funds from card to card from your personal account "Sberbank Online". Register on the Sberbank website, in the mobile application "My Sberbank Online", by phone using a support service operator, or get a login and password to enter Sberbank Online using a self-service device.

Step 2

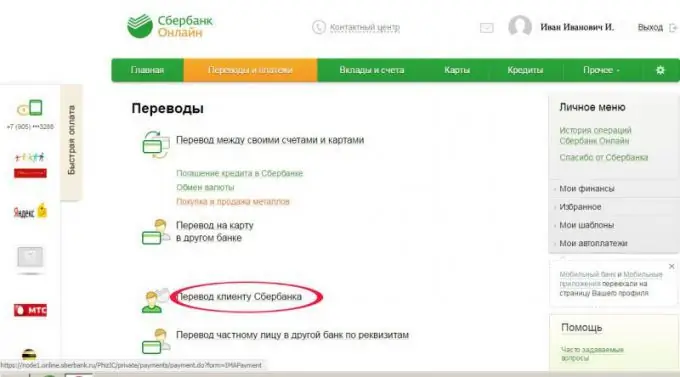

Enter your personal account "Sberbank Online" on your Internet access device by entering your username / identifier and password. Open the "Payments and Transfers" tab. Select "Transfer to Sberbank client".

Step 3

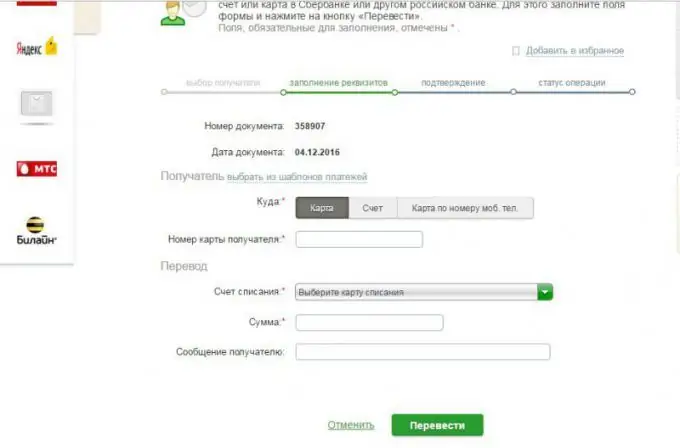

In the opened electronic transfer form, you can optionally enter the recipient's card number, make a transfer using his mobile phone number, or using the recipient's current account number. By default, the form opens with the option to enter the recipient's card number.

Step 4

Enter the card number of the recipient of the transfer in the appropriate field of the form, select the withdrawal card in the drop-down menu of the next field, write the transfer amount in the next line. If you want, write a message to the recipient of the transfer - it will come to him on his mobile phone in the form of an SMS message from subscriber "900". Sberbank provides this service free of charge. Please note that all fields marked with an asterisk must be filled in in the form, and it is not necessary to send a message to the recipient. After you fill in all the required fields, click the "Translate" button at the bottom of the form.

Step 5

In the next window, you will need to check the details of the operation and, if everything is correct, confirm the transfer. If you find any inaccuracy in the translation details, select the "cancel" option at the bottom of the form to return to the previous window and make the necessary changes. And if everything is correct, click "Confirm by SMS" to receive a confirmation code of the operation on your mobile.

Step 6

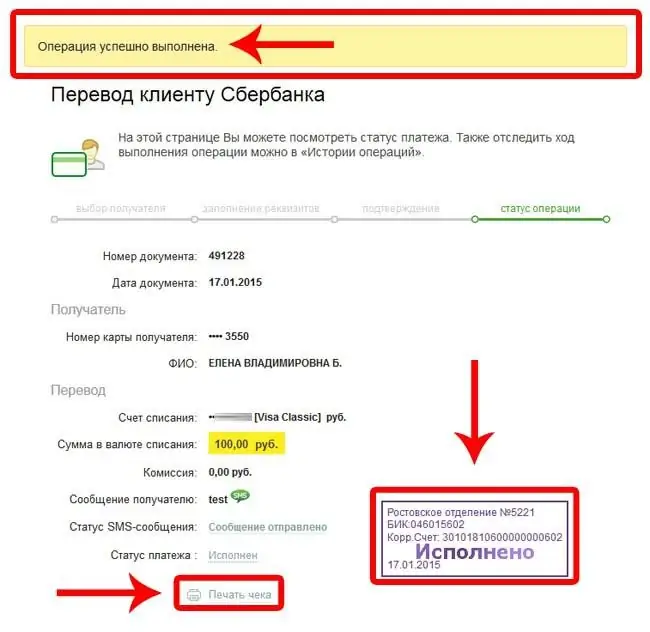

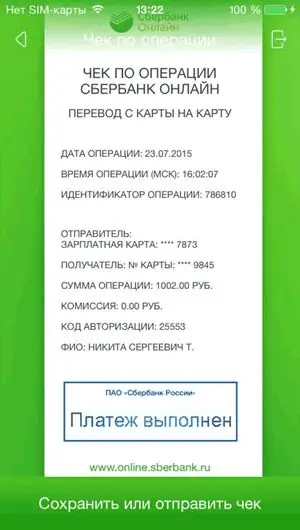

Here, in the pop-up window that will appear after your request for confirmation by SMS, enter the five-digit code from the message "900" received from the subscriber. The field for entering a code combination of numbers is at the very bottom of the form. Please note that the one-time SMS password you received is valid for 300 seconds. Then click "Continue". A window with a bank seal "Transfer completed successfully" will open, where you can print a check.

Step 7

It is not necessary to print it, but it will come in handy if something unexpected happens and the transfer does not reach the recipient. With this check, you can contact the bank for clarification. And if a printer is not installed on your device, when you click "Print receipt" it will be saved in PDF format. In any case, it is advisable to keep receipts from any banking transactions.

Step 8

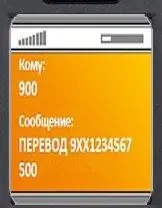

You can transfer funds directly from your mobile phone, the number of which is linked to your card using the "Mobile Bank" service. To do this, send an SMS message to number "900" with the following format: TRANSLATION 9 ******** XXX, where 9 **** is the recipient's mobile phone number in ten-digit format, and XXX is the transfer amount. There is a space between the phone number and the transfer amount. You can enter in Latin letters in the PEREVOD or PEREVESTI format.

Step 9

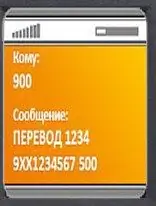

If the sender has more than one debit card, you need to choose which card to use for the transaction. Then in the message you need to indicate the last four digits of the selected card in the format TRANSLATE 1234 9 ******** XXX, where 1234 are the last digits of the card number, and the other parameters are the same as in the previous case. If you do not indicate the debit card in the SMS message, the bank will give priority to the salary card, if you have one.

Step 10

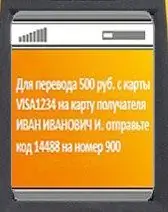

In the response message from the number "900" you will receive a notification with the full name of the transfer recipient's card and the transaction confirmation code.

Step 11

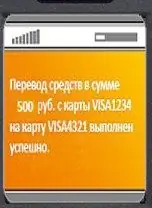

If the recipient's name is determined correctly, send in a reply message to the subscriber "900" the transaction confirmation code received in the previous SMS. After that, you will receive a notification about the successful completion of the operation.

Step 12

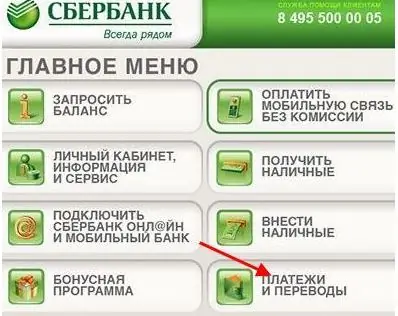

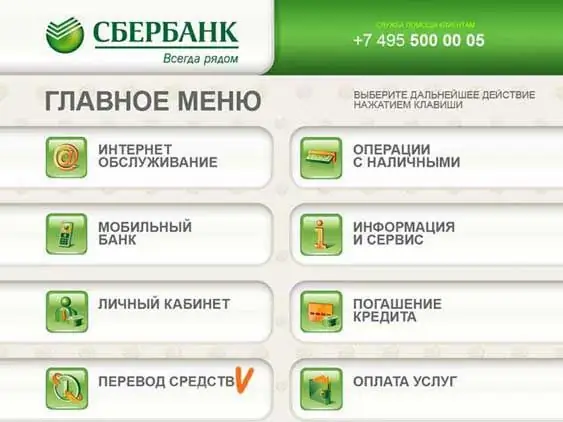

You can also transfer money from a card to a Sberbank card using a self-service device - an ATM or terminal. To do this, insert your card into the device, enter the PIN-code and select the "Payments and transfers" item in the main menu.

Step 13

In the next window, select "Transfer funds". After that, a window will appear with a line for entering the recipient's card number.

Step 14

Enter the card number of the transfer recipient without spaces and click "Next". In the next window, enter the transfer amount and confirm the operation. As in other cases, it is recommended to print the transaction receipt.