- Author Isaiah Gimson gimson@periodicalfinance.com.

- Public 2023-12-17 02:53.

- Last modified 2025-01-24 12:06.

Many citizens are faced with the question of how to fill out personal income tax 3 of the new form. It's actually quite simple, you can do it yourself and for free. This publication contains guidelines to help you understand the answer to the question posed. The most important thing is to read and observe them carefully.

What is the declaration for and who should fill it out?

Personal income tax return-3 is a document required for an individual to report to the state on the income received. It consists of 26 sheets that fill in:

- individual entrepreneurs;

- notaries, lawyers and other persons in private practice;

- citizens who have received an inheritance;

- winners of a lottery or other risk-based game;

- people who receive income from those who are not a tax agent (landlords);

- who have received profit for which no tax has been paid.

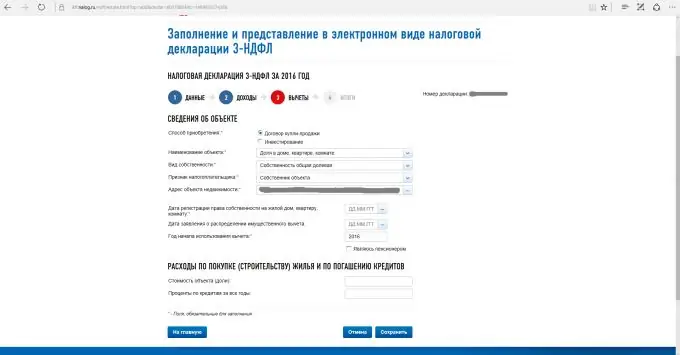

Program for filling 3-NDFL

The document in question is easiest to draw up with the help of the free utility "Declaration-2013", which can be downloaded from the website of the Federal Tax Service. Next, you need to install it on your personal computer.

The functionality of the program allows you to enter information about taxpayers, calculate totals, check the correctness of the calculation of deductions, benefits, and also generate a file in XML format. For the full-fledged operation of the Declaration-2013 program, minimum system requirements are imposed. If a person knows the 3-NDFL form, the program, how to fill in all the fields in it, taking into account all the features, he will draw up the document as quickly and correctly as possible.

"Declaration-2013". Part 1: filling out taxpayer information

First of all, you should start the new version of the program (shortcut on the desktop with a green letter D). In the window that appears, select the item "Setting conditions" located on the left panel. Now the reader will learn how to fill in personal income tax-3 using the Declaration-2013 program. If the taxpayer is a resident (stayed in Russia for more than six months), choose the type of document "3-NDFL", otherwise - "3-NDFL non-resident". In the "General information" column, enter the code of the tax office to which the information will be provided. Since the document in question is provided at the place of permanent registration, residents of the regional center do not fill in the "District" field.

Taxpayers who want to understand how to fill in personal income tax-3, and who submit their declaration for the first time in a year, leave zero in the "correction number" section. Otherwise, put one (you will need to clarify the early declaration). In the item "Sign of a taxpayer" a choice is made of who the person is. Further in the menu "There are incomes" should be ticked where the profit comes from.

"Declaration-2013". Part 2: who is filing the return?

In the program, it is necessary to clarify the accuracy of the delivery of documentation: either a person submits it for himself (mark "personally"), or for another individual ("Representative of the FL"), or he is a representative of the organization. If the formalities in question are carried out instead of another citizen, you will need to enter personal data and a document number, which may be:

- a power of attorney from a legal entity or individual;

- birth certificate if the representative is the parent of the child.

Now you need to click the "Save" button on the top toolbar to save all the data. The name of the declaration is entered in the window that appears. "Declaration-2013". Part 3: information about the declarant On the left side panel there is a tab “Information about the declarant”. Under the button where the information is saved, there is a button with an image that looks like a curbstone with an open drawer. When you click on it, you will need to fill in personal information: TIN (you can find out on the FTS website, but this field is optional), passport data, and save the changes made.

The next step is to click on the house-shaped button next to the previous one. In the panel that opens, the type of residence (permanent or temporary), address, telephone number and OKATO (All-Russian Classifier of Administrative-Territorial Division) are indicated.

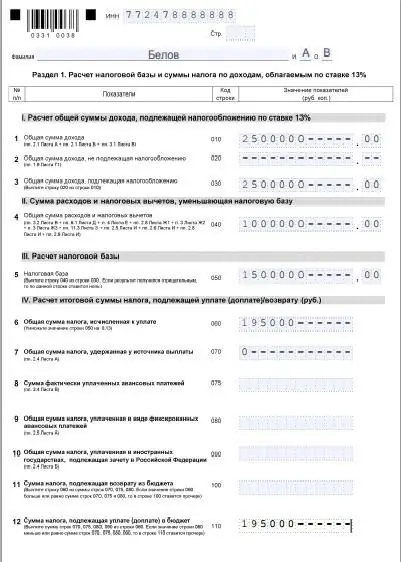

"Declaration-2013". Part 4: information about income and expenses

Entrepreneurs and individuals who want to understand how to fill out personal income tax (form 3) must correctly enter information about the income received. To do this, you will need a personal income tax certificate of the 2nd form, which can be obtained from the organization at the place of work that withholds income tax. Different types of profits are subject to their respective tax rates. For example, salary - 13%, material benefit - 35%, dividends - 9%. Each method of making a profit has a unique code: 2000 - wages, 2012 - funds for vacation, 2010 - income under GPC agreements, 2300 - sick leave, 1400 - rental income, 2720 - gifts. When calculating personal income tax, deductions (tax-free benefits) in the form of codes, which can be viewed in the help, should be taken into account. Based on all this data, we continue to figure out how to fill out a 3-NDFL certificate.

"Declaration-2013". Part 5: filling in the deduction column

This section has four tabs. Those who want to get an answer to the question of how to correctly fill out 3-NDFL should know that each of them corresponds to a certain category of deductions: standard, property, social and past losses from transactions with securities. Entering the first group, you must check the boxes in the required fields. If the taxpayer has children, then the label "Deduction per child (s)" should be left. The next field - "Deduction for a child (children) to the only parent" - raises no questions. The last field under the question mark means the deductions intended for a guardian or single parent, whose status has changed during the year. Further, information on the number of small family members is specified. Also, standard deductions are provided for codes 104 and 105.