- Author Isaiah Gimson gimson@periodicalfinance.com.

- Public 2023-12-17 02:53.

- Last modified 2025-01-24 12:06.

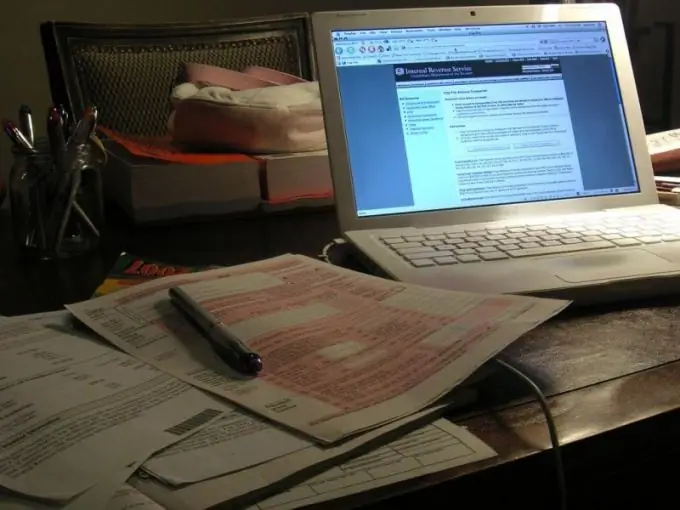

The biggest headache for an accountant is VAT. The slightest mistake in calculating and filling out a tax return can sometimes become fatal for a company, which is subject to large penalties and possible legal costs. To avoid these troubles, it is necessary to check the correctness of the VAT calculation.

Instructions

Step 1

Start checking with the general ledger. Verify the numbers and dates of the primary documentation that is used when filling out the accounting records. Check the correspondence between the amounts of payments and the VAT charged on them. If any of the information was recorded incorrectly, then make corrections before filing a tax return, otherwise these VAT amounts will be revealed during a tax office audit and will be subject to penalties.

Step 2

Analyze the balance sheet. Separately, make settlements on account 60 "Settlements with contractors and suppliers" and account 62 "Settlements with buyers and customers." Break down these indicators into subaccounts. Remember that sub-accounts 60.2 and 62.1 should be in debit only, and sub-accounts 60.1 and 62.1 only in credit. Otherwise, it is necessary to identify when an incorrect write has occurred. Reconcile the balance of these accounts at the end of the tax period with the balances of the sales and purchase ledger. They must match.

Step 3

Create a balance sheet for account 41 "Goods". Check that all balances are in debit and not highlighted in red. If you have identified an error in this case, then you need to review the invoices for the fact of the formation of a re-grading.

Step 4

Check the debit balance in the balance sheet of account 19 "VAT on acquired values". This value must be zero.

Step 5

Open the statement of sub-account 76 "Advances", if any, in the reporting period. Take the credit value of this account and compare it with the value obtained by multiplying the credit of sub-account 62.2 by the VAT rate. These amounts must be equal.

Step 6

Use the 1C program, in which you create a subconto for counterparties. Check the consistency of invoices, accompanying documents and amounts paid and received. If there are several contracts with one enterprise, it is advisable to form accounting for each agreement separately. This will avoid errors in VAT calculation.