- Author Isaiah Gimson gimson@periodicalfinance.com.

- Public 2023-12-17 02:53.

- Last modified 2025-01-24 12:06.

In world practice, the proposals of financial structures today are simply full of a wide selection of loans with various purposes, terms and rates. Before the final choice of an institution for applying for a loan, you must clearly know and be able to check the process of calculating interest on a loan.

It is necessary

- - loan agreement;

- - calculator;

- - Excel software;

Instructions

Step 1

Take a loan agreement and find an item on the rules for calculating interest on a loan. Typically, the payment schedule is of two types: classic and annuity. The classic schedule implies the payment of interest in the amount of the monthly body on the loan, and every month the payment decreases by a certain amount. An annuity schedule is the payment of interest and body every month in the same amounts, which do not change until the end of the loan term.

Step 2

Find in the agreement the initial loan amount, the term in months, if indicated in years, translate by multiplying by 12 and the annual rate as a percentage. Check all accompanying one-time and monthly fees for the text of the agreement. If, when issuing a loan, the bank ordered to insure the collateralized property - write down the amount of the insurance payment.

Step 3

Now, to calculate repayment by the classic type, take a calculator, a piece of paper and calculate using the formula: interest = (total loan amount) / (loan term in months) x (annual rate) / 365 x (30 or 31 [days of the month]) … The result is an interest payment for the first month. To calculate each subsequent payment, the initial amount must be changed to its balance of the loan body. The calculation of the monthly payment for the loan body is even simpler: monthly payment = (total loan amount) / (loan term in months). Total monthly payment = (monthly payment by body) + (interest).

Step 4

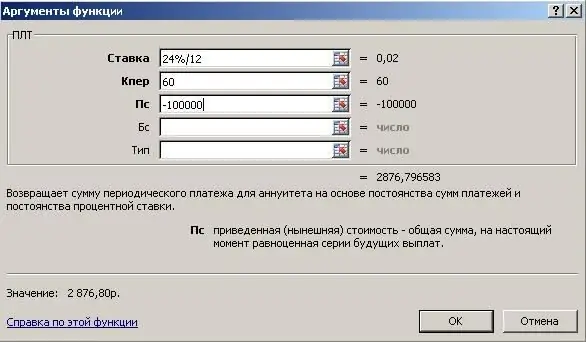

The annuity schedule is more difficult to calculate. It is better to use an Excel program for this, so as not to suffer with manual calculations. Open an Excel sheet and put an equal sign on any cell and select the PMT function. For example, your loan is 100,000, 00 rubles, at 24% per annum for 60 months, enter the following values into the drop-down list:

Step 5

Press the "OK" button and you will receive your monthly annuity payment. When entered manually, it will look like this:

= PMT (24% / 12; 60; -100000). In parentheses, you need to enter indicators in the following order: interest rate, number of months of lending, initial amount of debt. A minus in front of 100,000 means a debt obligation, if you do not put it, the total value will be simply negative.

Step 6

To understand the full amount of overpayments on a loan, you can calculate the so-called effective rate. Effective loan rate = ([loan body + interest for the entire term + commissions] / loan term in years) / weighted average loan amount. Weighted average loan amount: loan amount x (loan term in months + 1) / (2 * loan term in months). As a result, you will find out how much the real interest rate on the loan really is.