- Author Isaiah Gimson [email protected].

- Public 2023-12-17 02:53.

- Last modified 2025-01-24 12:06.

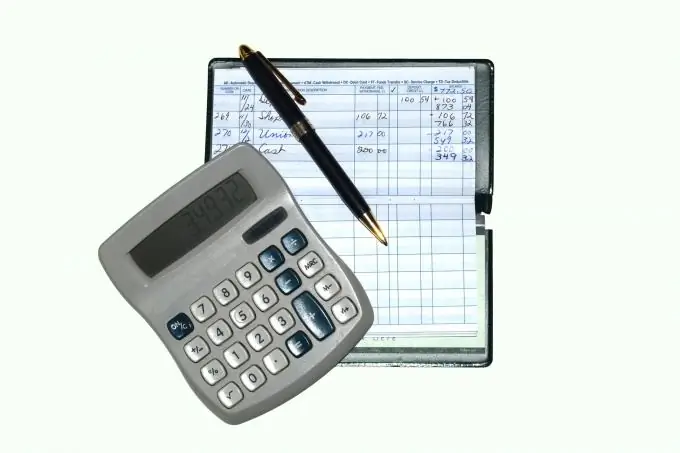

The issued invoice is the main basis for paying for your services or goods for the customer's accounting. If it comes to checking your business, the presence of an account can compensate for the absence of other documents (agreement, acts), although it is better to have a complete set. The preparation of this document is not as difficult as it might seem. An accounting education is certainly not required.

Instructions

Step 1

You can use any text editor to issue an invoice and generate an act of acceptance and transfer of works or goods or services. But it is better to do this with Exel or a specialized accounting program. They will eliminate the likelihood of errors in calculating the total amount, since they produce it automatically.

Step 2

The word “Invoice” is used as the title (in capital letters in the center of the first line), and the number and date of issue are assigned to it. The line below, if there is a contract, usually provides its output data, for example, "to the contract for the provision of paid services No. 1-RK dated 2011-01-02."

Step 3

Next, you provide the legal addresses and bank details of the parties, first yours, then the customer. You can call yourself "Recipient", and the other party "Payer", the wording "Contractor" and "Customer" or others that appear in the agreement are also acceptable.

The name of the party is followed by a colon, followed by its name, legal address and details.

Step 4

The next part of the invoice is a table: the number in order, the name of the product or service, unit of measure, quantity, price and amount (price multiplied by the number of units of measure).

Percentages, kilograms, tons, boxes, pieces, the number of characters in the text with and without spaces, depending on the situation, can be used as units of measurement.

The names of each service rendered or goods delivered, work performed must be formulated in the same way as in other documents: contract, invoices, acts, etc.

Step 5

In the very bottom line of the table, after the word "Total", you must indicate the total amount of the payment to be invoiced, in rubles and kopecks or another currency. Below is the amount including VAT.

If you are not a VAT payer, you must indicate that this tax is not levied, and the reason for this. Most often it is written: "VAT is not charged, since the Contractor (Recipient) applies a simplified taxation system", then the output data of the corresponding notification is indicated in brackets: document name, number, date of issue and issuing authority (your territorial tax office).

For example: "Notice No. 111 dated 01.10.2011, IFTS-15 in Moscow."

Step 6

Below the table, after the words "Total for payment" and the colon, in words indicate the final amount of the payment in rubles and kopecks.

The head of the organization and the chief accountant must sign the invoice. If there is no accountant, the head or an individual entrepreneur signs for both.

The document is also certified by a seal.

Step 7

You can send the invoice to the payer by fax or by courier.

A very common option is when a document is scanned and sent over the Internet, and payment is made on this basis. The original is sent by mail or sent by courier.